ICAI released Very Important Technical Guide on GST Reconciliation Statement (Form GSTR 9C)

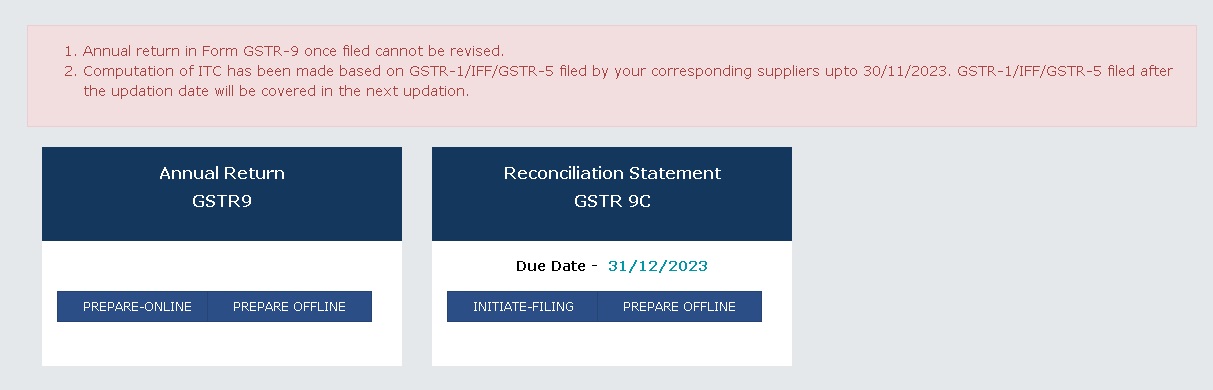

The Institute of Chartered Accountants of India (“ICAI”) released the Very Important Technical Guide on GST Reconciliation Statement (Form GSTR 9C), (November 2023).

Read More