GST is considered a self-assessment tax under Section 59 of the CGST Act, where the taxpayers are responsible for evaluating their tax liabilities and reporting them through GST Returns. However, it is crucial from a revenue perspective to ensure whether the Taxpayer has accurately assessed their tax liability. The audit system was introduced under the GST Act 2017 to safeguard the revenue.

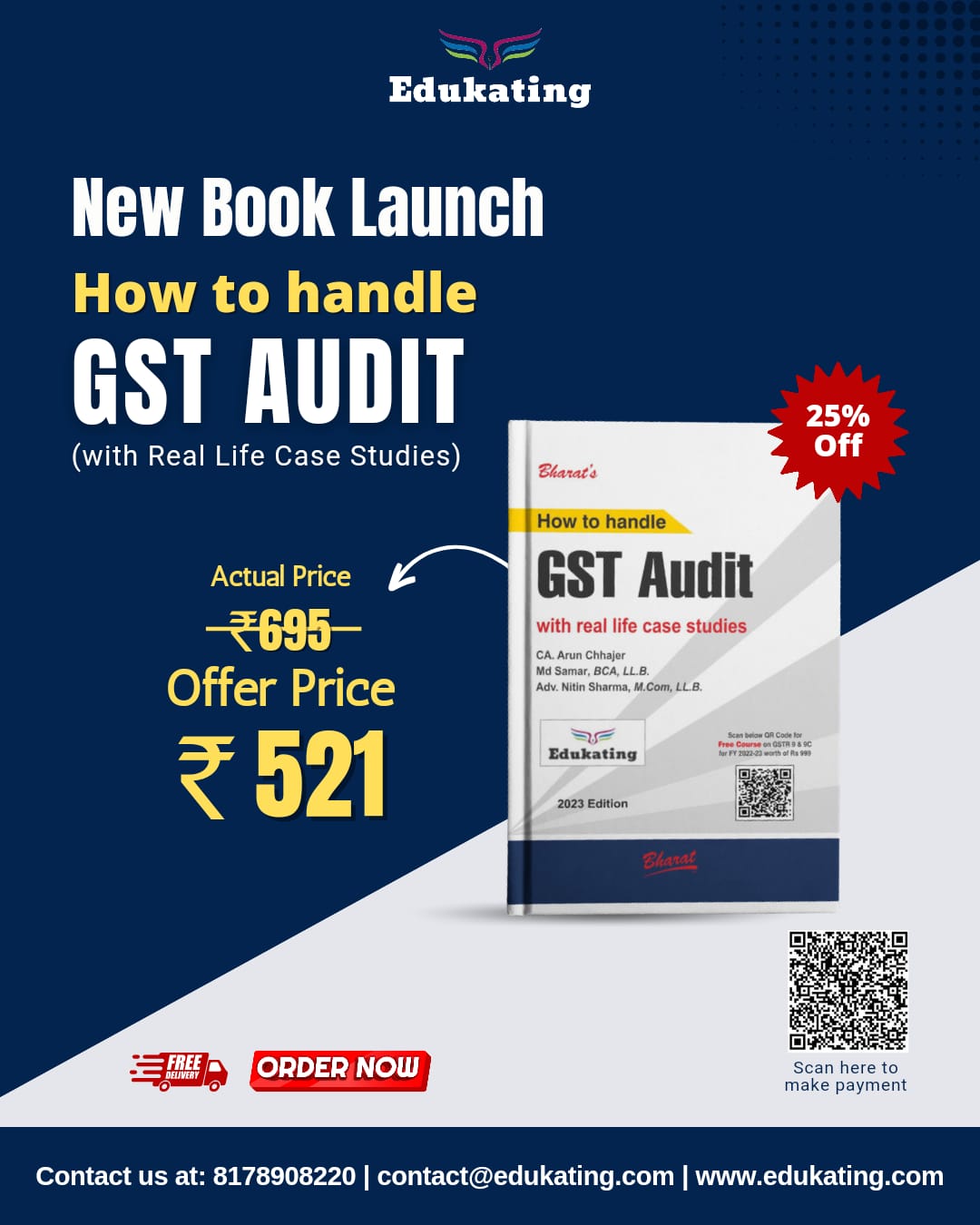

By reading the GST Audit book, Readers would gain the necessary knowledge and tools to navigate GST audits successfully. With a clear understanding of the audit process and proactive measures, businesses can mitigate the risk of financial penalties and safeguard their operations.

GST audits can be complex and daunting, but with the insights and guidance provided in this book, whether it is a Taxpayer or tax consultant, one can approach GST audits with confidence, ensuring compliance and protecting financial interests.

In this book, we will discuss the GST audit in detail. We will cover the following topics:

1. GST Audit: Shedding Light on the Essence of a GST Audit

2. Revealing the Entities Subject to GST Audit

3. Dimensions of GST Audit Coverage

4. Key Objective of GST Audit

5. Spectrum of Audits in GST

6. Core Principles of GST Audit

7. Unleashing Auditee's Rights in GST Audits

8. The Audit Journey: Step-by-Step Procedures of GST Audits

9. The Aftermath of Audits

10. Essential Records for GST Compliance

11. How to handle GST Audit: Case Study Analysis and Practical Strategies for GST Compliance

Make Payment- Google pay No. 9810406622

UPI ID:- capooja.garg@okhdfcbank

After Payment Fill This Form- https://forms.gle/mHrmGDQfrGfs4FtUA