GST on solar based devices

Background

The reliance upon solar power based devices has seen a tremendous increase in the past few decades. People are moving towards a better renewable form of energy and adapting the same in their day to day lives. Even in terms of usage solar power is considered safer to use and requires less maintenance and repair as compared to other conventional power resources. Solar power converts renewable energy from the sun into electricity either directly through photovoltaics or indirectly through concentrated solar power. The electrical energy generated from the conversion of sunlight is called solar power. The products directly or indirectly powered by sunlight are called solar power based devices.

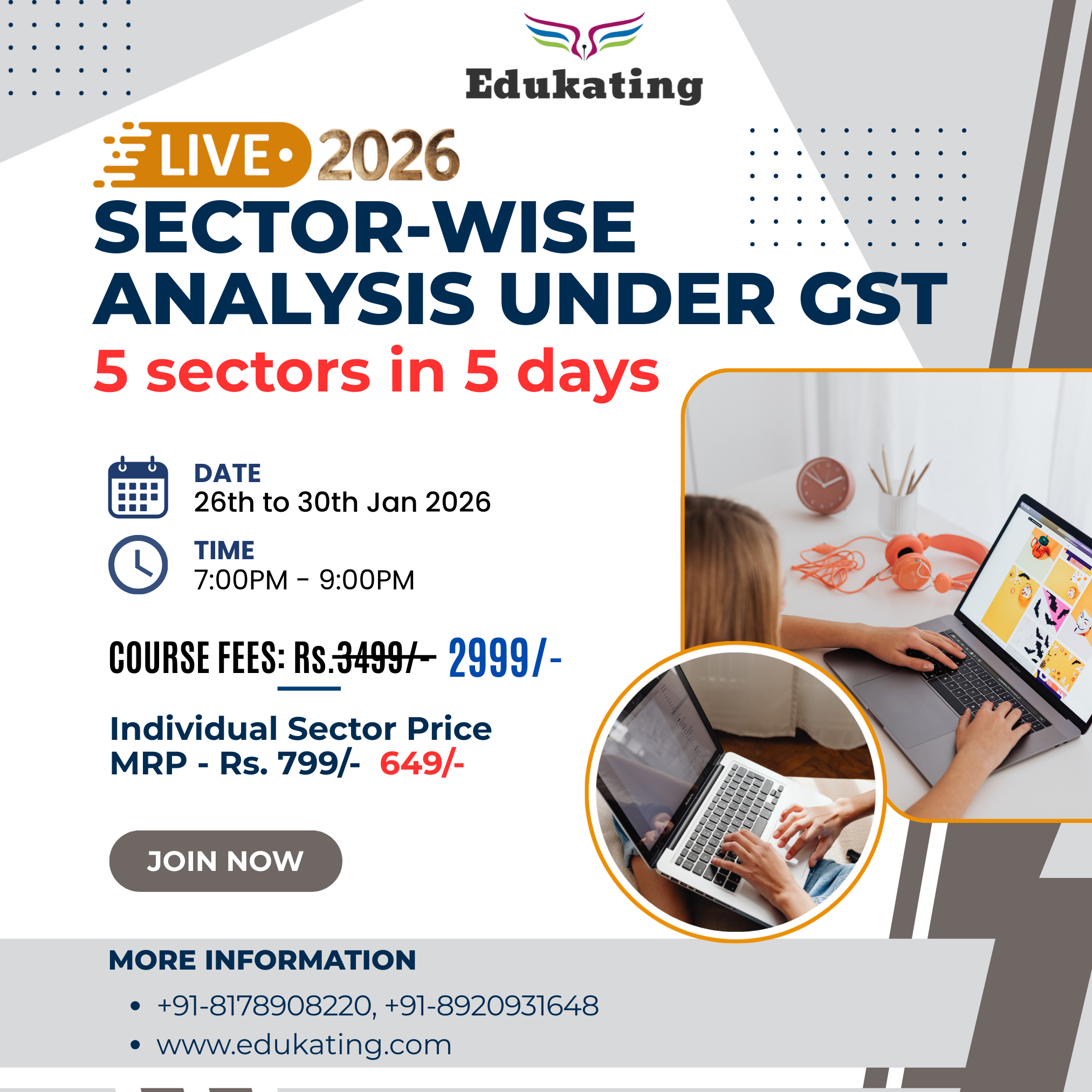

GST implications differ from industry to industry and many a times even product wise. Therefore, understanding the GST implication specific to that industry / product / service / sector is necessary to ensure that the requisite compliance requirements are met properly and timely.

GST Rate Structure overview

|

Category |

01/07/2017 – 31/12/2018 |

01/01/2019 – 30/09/2021 |

01/10/2021 – till date |

|

Goods falling under Chapters 84, 85 or 94 |

5%

|

5%

|

12% (NN 8/2021 – CT Rate dated 30.09.2021 w.e.f. 01.10.2021) |

|

Composite Supply (except maintenance services) |

8.90% (70% of 5% + 30% of 18%) Circular 163 Benefit of 70:30 would be available to the period prior to 1.1.2019 but no refund |

8.90% (70% of 5% + 30% of 18%) Explanation inserted vide NN 24/2018 – CT (Rate) dated 31.12.2018 w.e.f. 01.01.2019 |

13.80% (70% of 12% + 30% of 18%) |

|

Composite Supply (maintenance services / AMC) |

18% |

18% |

18% |

GST rates on Solar PV Power Projects: GST on specified Renewable Energy Projects can be paid in terms of the 70:30 ratio for goods and services, respectively, with effect from 1st January, 2019.

An explanation was inserted vide the said NN 24/2018- Central Tax (Rate), dated 31st December, 2018 As per this explanation, if the goods specified in this entry are supplied, by a supplier, along with supplies of other goods and services, one of which being a taxable service specified in the entry at S.No. 38 [Service of construction or engineering or installation or other technical services provided in relation to setting up of Bio-gas plant, Solar power based devices etc.] notification No. 11/2017-Central Tax (Rate), the value of supply of goods for the purposes of this entry shall be deemed as 70% of the gross consideration charged for all such supplies, and the remaining 30% of the gross consideration charged shall be deemed as value of the said taxable service.

Clarification rendered by Circular No. 163/19/2021-GST dated 06/10/2021

Via Circular No. 163/19/2021 CBIC has provided clarification regarding the applicability of GST Rates on Solar PV Power Projects. The relevant extract of the Circular is reproduced below for reference:

“13.3 The GST Council has now decided to clarify that GST on such specified Renewable Energy Projects can be paid in terms of the 70:30 ratio for goods and services, respectively, for the period of 1st July, 2017 to 31st December, 2018, in the same manner as has been prescribed for the period on or after 1st January, 2019, as per the explanation in the Notification No.24/2018 dated 31st December, 2018. However, it is specified that, no refunds will be granted if GST already paid is more than the amount determined using this mechanism.”

Solar energy products and its classification –

- Solar controller: It measures the effectiveness of the overall setup and establishes the battery life. It is not a solar-powered appliance. Therefore, it will be taxed at 18% under HSN 8504, which is defined as “Electrical transformers, static converters, and inductors.

- Solar structure: They are not solar power-based or solar power-based devices, according to the solar structure. Solar structures are therefore subject to GST at 18%.

- Solar panels: They are series-connected structures comprised of solar cells. They are constructed from a semiconductor material, which transforms solar radiation into electrical energy. They are therefore regarded as solar power-based equipment and subject to 12% GST.

- Solar water heater and system: Solar water heater and system will be taxed at a rate of 5%

- Solar power generating system: Solar power generating system will be taxed at 12% GST.

- Solar inverter: Solar inverter will be taxed at 12% GST

- Solar lantern/solar lamp: It will be taxed at 12% GST

- Solar power-based devices: Solar power-based devices will be taxed at 12% GST.

- Solar roof top: GST on solar roof top is 12%.

Different parts of the Solar with HSN and Rate

|

No. |

Item |

|

HSN Code |

Applicable Tax |

|

1. |

Solar modules |

|

8541 |

12% |

|

2. |

Solar Inverter with PV module |

|

8504 |

12% |

|

3. |

Solar Water Heater |

|

841912 |

12% |

|

4. |

Battery |

|

8705 |

28% |

|

5. |

Al Mounting Structure |

|

7610 |

18% |

|

6. |

GI Mounting Structure |

|

7308 |

18% |

|

7. |

Plumbing/Piping |

|

7304 |

18% |

|

8. |

Solar Charge Controller with PV module |

|

5804 |

12% |

|

9. |

Data Loggers, Wi-Fi |

|

8517 |

18% |

|

10. |

Solar Lantern, Solar street light, Solar Home lighting kit with PV module |

|

9405 |

12% |

|

11. |

Cables |

|

8544 |

18% |

|

12. |

Earthing/Safety/LA |

|

8536 |

18% |

|

13. |

Cable tray, accessories |

|

7308 |

18% |

|

14. |

Erection, Installation & Commissioning Services |

|

9954 |

18% |

Advance Ruling on Solar Power Project

(Advance Ruling No. GST-ARA-01/2017B-01, dated 17th February 2018)

Applicant has sought ruling on the following questions:

Whether EPC contract for set up of solar power generating system be considered as a composite supply with PV modules being the principal supply and be taxed at a rate of 5% (i.e. tax rate applicable on the P. V. modules)?

Held that— As per the statement of facts submitted by the applicant, the scope of work in respect of “Turnkey Composite EPC Contract” includes designing, planning civil works, procurement of good, erection, testing and commissioning. Accordingly, “Turnkey EPC Contract” is not covered under Entry 234 of Schedule I of the Notification no. 1/2017 - Central Tax (Rate).

The contract for Erection, Procurement and Commissioning of Solar Power Plant falls under the ambit “Works Contract Services” (SAC 9954) of Notification no. 11/2017 Central Tax (Rate) dated 28 June, 2017 and attracts 18% rate of tax

Authority for Advance Ruling, Haryana held that (i) the combination of solar panel, inverter, solar battery and charge controller may qualify as “Solar Power Generating System. If said items are supply in the assemble form, it will be covered under “Solar Power Generating System” and will be treated as composite supply. Accordingly, rate prescribed in GST vide Notification no. 01/2017-Central tax (Rate) dated 27.01.2017 will be 12% for “Solar Power Generating System” is applicable. However, if the said items are supplied individually and their value is also shown in the invoice individually, then the said supply will be treated as mixed supply.

(ii) As the combination of solar inverter & battery do not make “Solar Power Generating System”, thus the said supply will be treated as mixed supply and rate of GST will be 18%. The rate of GST does not alter whether the supply has been made by the manufacturer or trader.

Classification of supply— In the instant case, applicant is engaged in the business of setting up of Solar Power Generating System (SPGS) on turnkey basis. applicant has sought a ruling with regard to the following: -

- Whether the EPC contract for complete design, engineering, manufacture, procurement, testing inspection and complete erection and commissioning of Solar Power Generating System will result into `Composite Supply` as defined in Section 2 (30) of the Central Goods and Services Tax Act, 2017?

- In case the supply of SPGS is treated as `Composite Supply, whether supply of PV Modules/ Inverters or any other supply covered under Chapter Heading 84, 85 or 94 of Central Tax Notification will be treated as `Principal Supply?`

- In case the principal supply be treated as `supply of PV Modules/ Inverters` or any other supply covered under Chapter Heading 84, 85 or 94 of Central Tax Notification, whether the concessional rate of 5% be applicable on the entire of value of the contract i.e. supply of SPGS?

Held that—The supply of Solar Power Generating System along with other goods and service of designing, erection, commissioning & installation of the same is classified under SI no. 234 of Notification No.1/2017-Central Tax (Rate) dated 28.6.2017 The supply of goods along with service of designing, erection, commissioning & installation of Solar Power Generating System along with other goods is covered under SI No. 234 of Notification No.1/2017-Central Tax (Rate) dated 28.6.2017

Applicant has sought ruling on the following questions:

Whether EPC contract for set up of solar power generating system be considered as a composite supply with PV modules being the principal supply and be taxed at a rate of 5% (i.e. tax rate applicable on the P. V. modules)?

Held that— As per the statement of facts submitted by the applicant, the scope of work in respect of “Turnkey Composite EPC Contract” includes designing, planning civil works, procurement of good, erection, testing and commissioning. Accordingly, “Turnkey EPC Contract” is not covered under Entry 234 of Schedule I of the Notification no. 1/2017 - Central Tax (Rate).

The contract for Erection, Procurement and Commissioning of Solar Power Plant falls under the ambit “Works Contract Services” (SAC 9954) of Notification no. 11/2017 Central Tax (Rate) dated 28 June, 2017 and attracts 18% rate of tax

Relevant extract of the notifications

NN 1/2017 Central Tax Rate – Schedule II [From 1.10.2021 – The rate is 12%]

NN 11/2017 Central Tax Rate –Tax Rate notification for services

================================