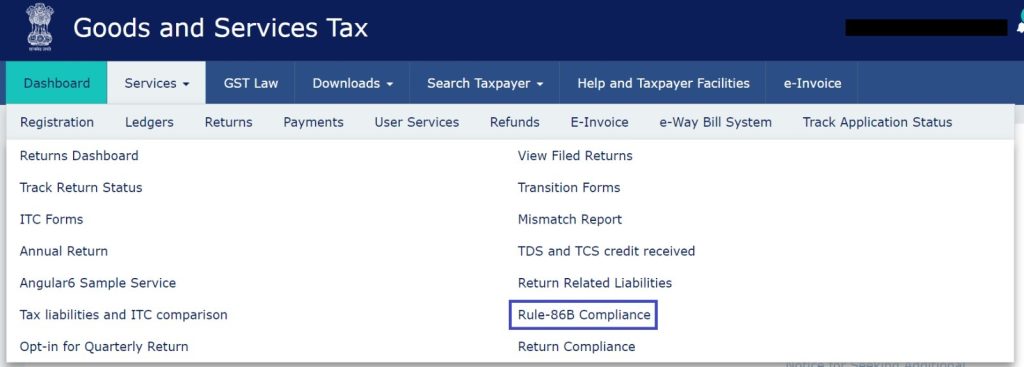

GSTN introduced a new tab, Rule-86B, which restricts the use of the amount available in the ECL

The Goods and Services Tax Network (“GSTN”) has introduced a new tab, Rule-86B, which restricts the use of the amount available in the Electronic Credit Ledger. Under this rule, a 99% restriction is imposed on the Input Tax Credit (“ITC”) available in the Electronic Credit Ledger of a Registered Person. This implies that 1% of the output liability must be paid in cash. The limitation is applicable when the value of taxable supply, excluding exempt and zero-rated supply, in a month exceeds Rs. Fifty Lakh Rupees.

Source - GST Portal