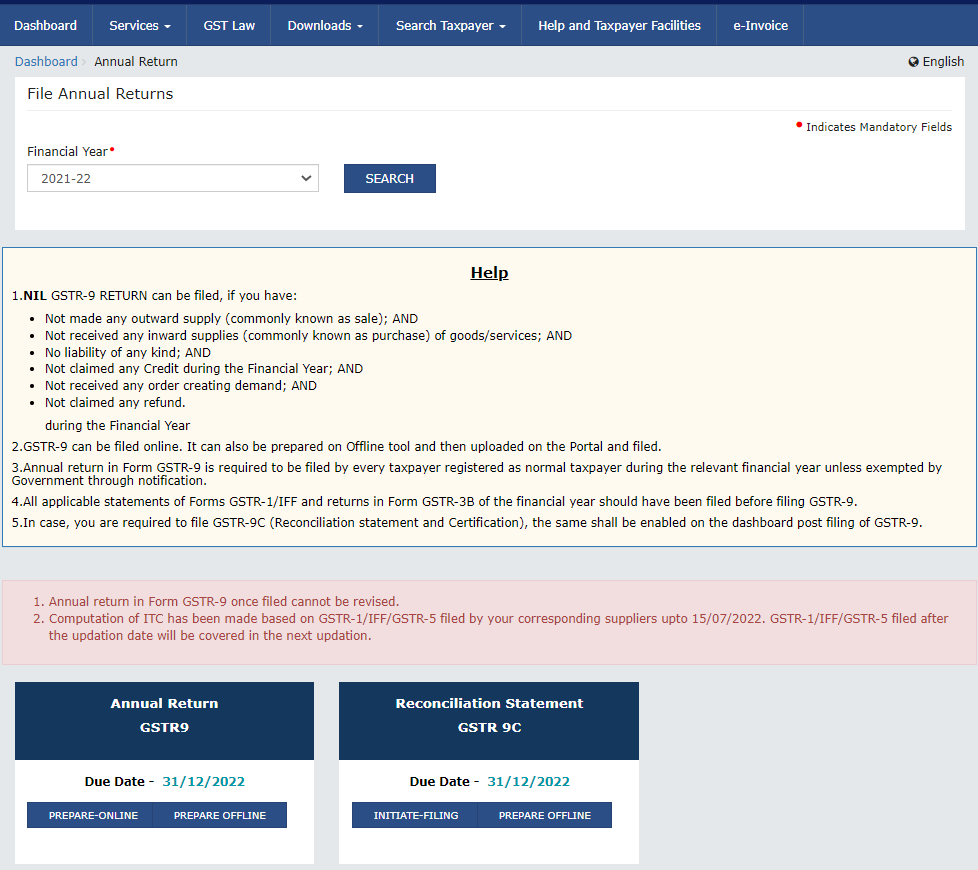

GSTN enabled GSTR-9 & GSTR-9C for F.Y. 2021-22 on GST Portal

The Goods and Services Tax Network (“GSTN”) has enabled GSTR-9 & 9C for Financial Year (“FY”) 2021-22 for filing on the GST Portal.

- GSTR 9 – Annual Return | GSTR 9C Reconciliation Statement

- The due date for filing GSTR-9 & GSTR-9C is December 31, 2022.

- The taxpayers whose aggregate turnover in the FY 2021-22 is up to INR 2 crore have been exempted from filing annual return.

Source - GST Portal