Govt Reduces Compliance Burden For GST Taxpayers

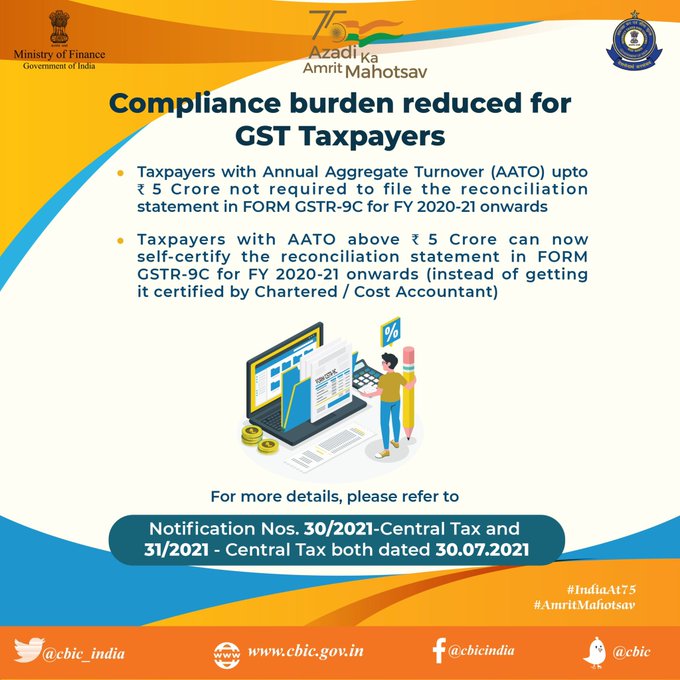

In a good news, the Ministry of Finance on Sunday announced new relaxations for the goods and services tax (GST) taxpayers. Taking to Twitter, the Ministry said that taxpayers with Annual Aggregate Turnover (AATO) up to Rs 5 crore are not required to file the reconciliation statement in Form GSTR-9C for fiscal year (FY) 2020-21 onwards.

Ministry also provided relief to taxpayers AATO above Rs 5 crore. Taxpayers AATO above Rs 5 crore can now self-certify the reconciliation statement in Form GSTR-9C for FY 2021-21 onwards, instead of getting it certified by a charted /cost accountant.

Meanwhile, taxpayers having AATO upto Rs 2 crore only are now not required to file Annual Return (Form GSTR-9) for FY 2021-21.

Earlier on December 1, the Ministry of Finance had informed that GST revenue of Rs 1,31,526 crore collected in November was the second-highest since the implementation of GST, second only to that in April 2021, which related to year-end revenues and higher than last month’s collection, which also included the impact of returns required to be filed quarterly.

This includes Central GST which is Rs 23,978 crore, State GST which is Rs 31,127 crore and International GST which is Rs 66,815 crore, Rs 32,165 crore collected on import of goods and Cess of Rs 9,606 crore (including Rs 653 crore collected on import of goods), the Ministry said.

Source - https://www.india.com/news/india/reduce-compliance-burden-for-gst-taxpayers-details-here-5135584/