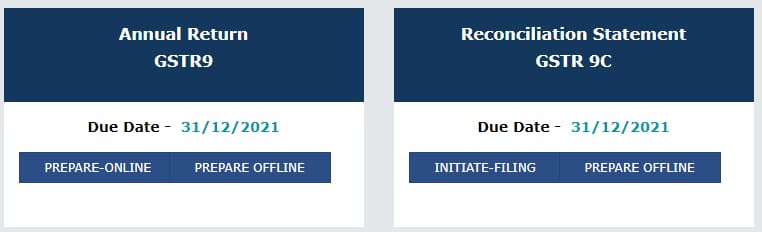

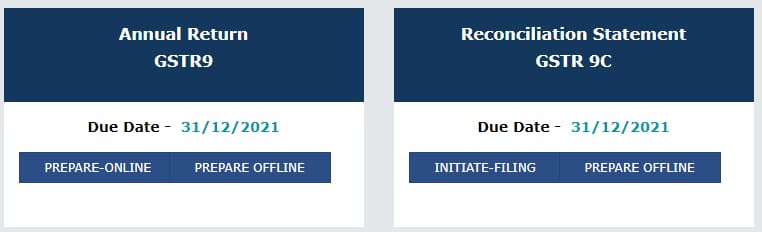

GSTR 9C made available at portal

The reconciliation statement (GSTR-9C) for the FY 2020-21 is available on the portal for filing.

Important Notes-

NIL GSTR-9 RETURN can be filed, if you have:

-

Not made any outward supply (commonly known as sale); AND

-

Not received any inward supplies (commonly known as purchase) of goods/services; AND

-

No liability of any kind; AND

-

Not claimed any Credit during the Financial Year; AND

-

Not received any order creating demand; AND

-

Not claimed any refund.

during the Financial Year

2. GSTR-9 can be filed online. It can also be prepared on the Offline tool and then uploaded on the Portal and filed.

3. Annual return in Form GSTR-9 is required to be filed by every taxpayer registered as a normal taxpayer during the relevant financial year unless exempted by Government through notification.

4. All applicable statements of Forms GSTR-1/IFF and returns in Form GSTR-3B of the financial year should have been filed before filing GSTR-9.

5. In case, you are required to file GSTR-9C (Reconciliation Statement and Certification), the same shall be enabled on the dashboard post filing of GSTR-9.

6. Annual return in Form GSTR-9 once filed cannot be revised.

7. Computation of ITC has been made based on GSTR-1/IFF/GSTR-5 filed by your corresponding suppliers up to 15/07/2021.

8. GSTR-1/IFF/GSTR-5 filed after the updation date will be covered in the next update.

Source- GST Portal