FORM 26QC : Complete Process

Are you a tenant paying rent? Here’s what you need to know!

Did you know that if you are paying rent of more than Rs. 50,000 per month, you must deduct TDS and file FORM 26QC?

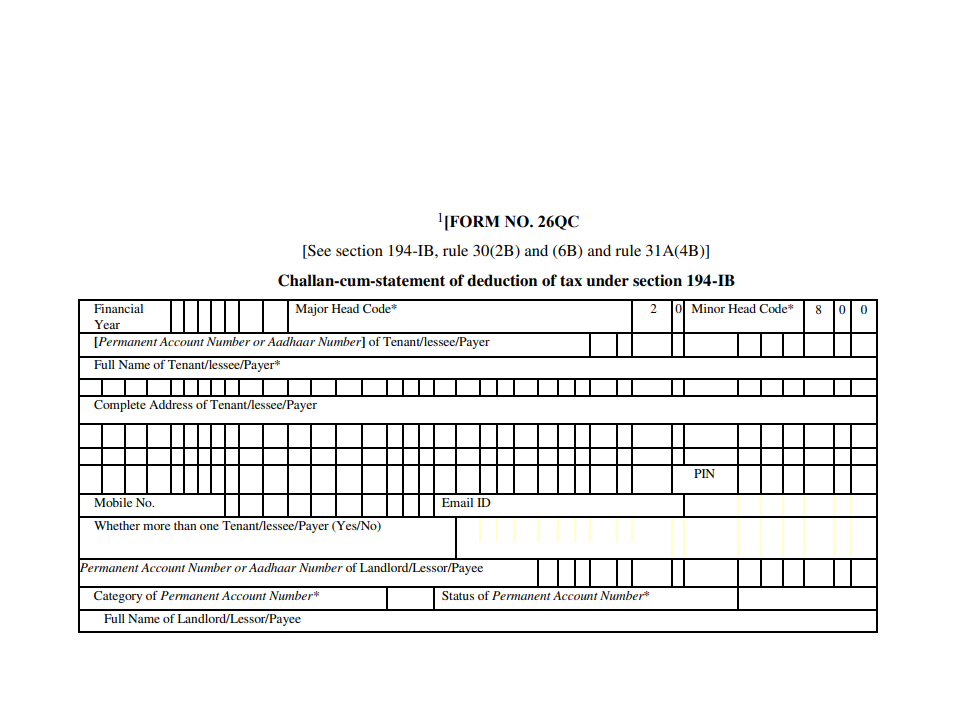

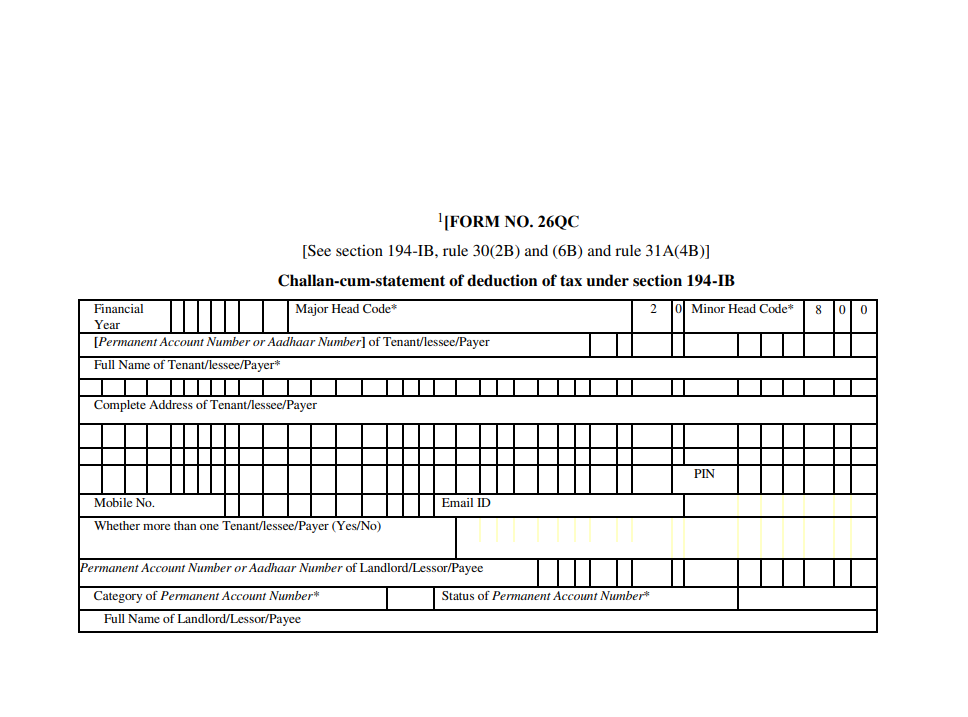

What is FORM 26QC? FORM 26QC is a mandatory form that must be filed by the tenant, who is responsible for paying rent to a resident landlord. TDS at a rate of 5% needs to be deducted on the rent paid.

Due Date for Filing FORM 26QC: The tenant must file FORM 26QC within 30 days from the end of the financial year, the date the property is vacated, or the termination of the rent agreement—whichever comes first.

For FY 2024-25, the last date to file is 30th April, 2025.

Where to file FORM 26QC? You can easily file FORM 26QC on the Income Tax Portal.

For a detailed guide on how to file FORM 26QC, check out the link below!

#TDS #FORM26QC #IncomeTax #RentPayment #TaxFiling #TaxCompliance #FinancialYear #TaxTips

Online TDS payment procedure under Section 194-IB

Download the attachment given above FORM 26QC_Complete_Process